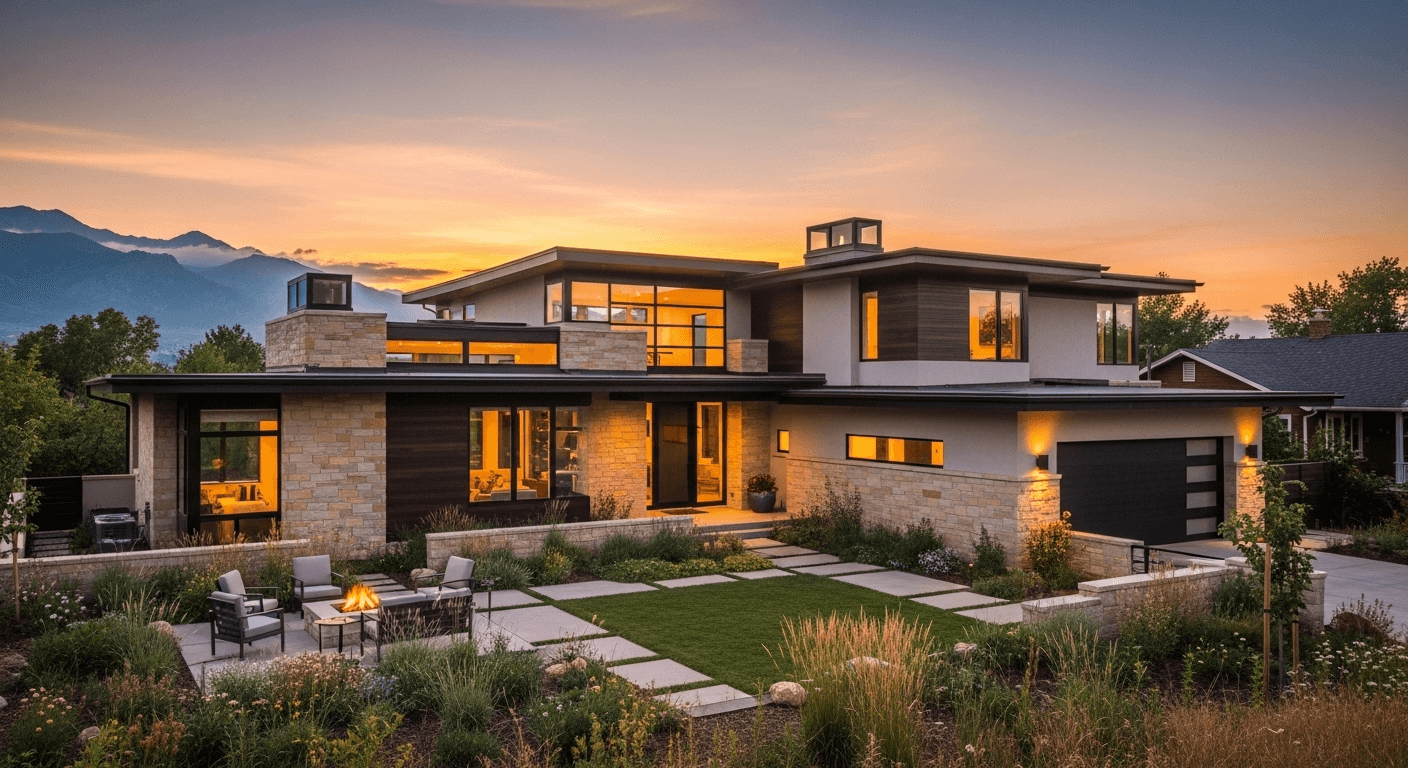

Find Real EstateThat Cash Flows

Analyze real estate with powerful financial metrics, AI insights, and data-driven tools to maximize your ROI.

Discover Investment Opportunities

Browse properties with instant financial metrics to identify the best deals

Everything You Need to Invest Smarter

Powerful tools and insights to help you find, analyze, and secure profitable investment properties

Smart Property Search

Search thousands of properties with advanced filters for location, price, bedrooms, and more.

Investment Calculator

Calculate cash flow, cap rate, ROI, and cash-on-cash return with customizable assumptions.

Market Analytics

Access detailed market data, price history, tax information, and comparable properties.

AI-Powered Insights

Get instant AI analysis of properties with personalized recommendations and risk assessment.

Location Intelligence

Evaluate neighborhoods with walk scores, transit scores, school ratings, and local amenities data.

Save & Compare

Save favorite properties and make informed decisions.

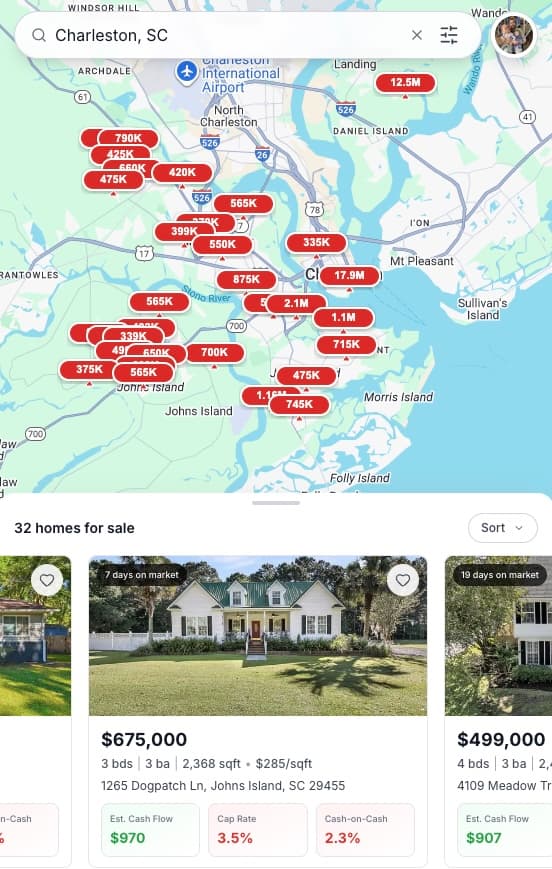

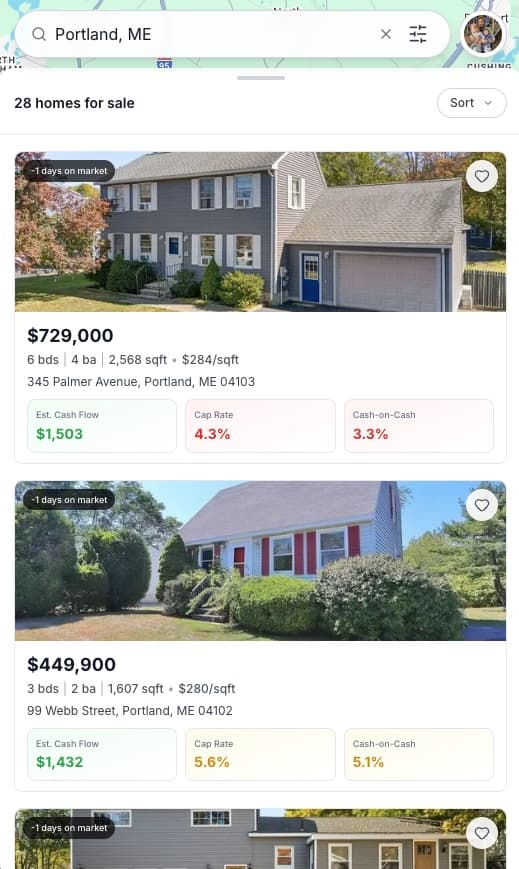

Discover Properties with Interactive Map Search

Explore investment opportunities with our advanced map-based search. Filter by location, price range, property type, and instantly see financial metrics for every listing.

Search Anywhere

Browse properties across 20,000+ cities nationwide

Smart Filters

Refine results by beds, baths, price, property type, and more

Instant Analysis

See cap rate, cash flow, and ROI calculated in real-time

Key Investment Metrics

Make data-driven decisions with comprehensive financial analysis

Monthly Cash Flow

Net income after all expenses including mortgage, taxes, insurance, and operating costs

NOI ÷ 12 - Monthly Debt Service

Cap Rate

Capitalization rate showing property return as a percentage of purchase price

NOI ÷ Purchase Price

Cash-on-Cash Return

Annual return on your actual cash invested in the property

Annual Cash Flow ÷ Cash Invested

DSCR (Debt Service Coverage Ratio)

Measures the property's ability to cover mortgage payments

NOI ÷ Total Debt Service

Annual NOI

Net Operating Income after all operating expenses but before debt service

Gross Income - Operating Expenses

1% Rule

Quick screening tool - monthly rent should equal 1% of purchase price

Monthly Rent ÷ Purchase Price

Sample Analysis

$450,000 Property · $3,750/mo rent

Cash Flow

PositiveNet income after expenses

Cap Rate

AnnualStrong: >8%

Cash-on-Cash

ReturnStrong: >8%

Cash Needed

UpfrontDown + closing costs

DSCR

RatioStrong: >1.25x

1% Rule

CloseTarget: ≥1% of price

Annual NOI

NetNet operating income

Monthly Debt

PaymentMortgage payment

Down Payment

20%Cash required upfront

Est. Rent

MonthlyEstimated rental income

How It Works

Start analyzing properties in seconds with our simple 3-step process

Search Properties

Enter a location and filter by price, bedrooms, property type, and more to find potential investments.

Analyze Metrics

View instant financial calculations including cash flow, cap rate, ROI, and get AI-powered insights.

Make Decisions

Save your favorites and make confident investment decisions.

Ready to Find Your Next Investment?

Join thousands of investors who use PropertyDNA to make smarter real estate decisions. Start analyzing properties for free today.